The Uganda People’s Congress party (UPC) has urged the government to draft policies that are fair to the citizens, stating that taxpayers are being overstretched.

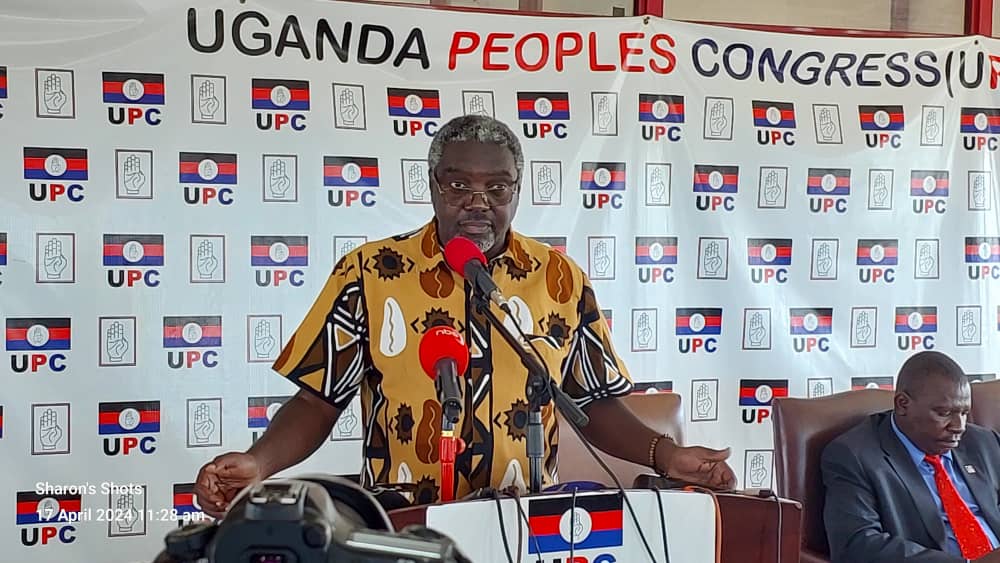

These statements were made during the party’s weekly press conference, chaired by Party President Jimmy Akena, on April 17, 2024, at the party headquarters in Uganda House, Kampala.

The party president stated that during the introduction of any tax policy or system, the government has the mandate to involve and educate all the stakeholders on how the policy has to work.

“Today there is tension between the Uganda Revenue Authority (URA) and the Trade industry which has concerns with the implementation of the new Electronic Fiscal Receipting and Invoicing Solution (EFRIS), which has led to the closure of business in Kampala and other parts of the country because the business community lacks sufficient knowledge on the new system. URA should focus on educating and engaging with the business community about the policy,” Akena stated.

Akena added that UPC has been keenly following the issue of tax waivers, which has highly favoured foreign investors at the expense of local investors.

“Much as we need to influence foreign investment as a country, we should not sacrifice the local companies, as this may undermine the efforts of Buy Uganda, Build Uganda (BUBU). As UPC, we demand fairness and equity in the implementation of such policies without discrimination, so that the tension in the trade sector can be reduced,” he added.

According to Akena, the introduction of new tax policies and programmes is aimed at collecting the targeted UGX. 31.574 trillion in taxes in the Financial Year (FY) 2024/25 from the ever-growing national budget of the country, with the tax payer hoping for good service delivery, hence escalating tensions.

EFRIS is a tool designed to monitor the payment of value-added tax (VAT) and facilitate accurate record-keeping for business transactions.