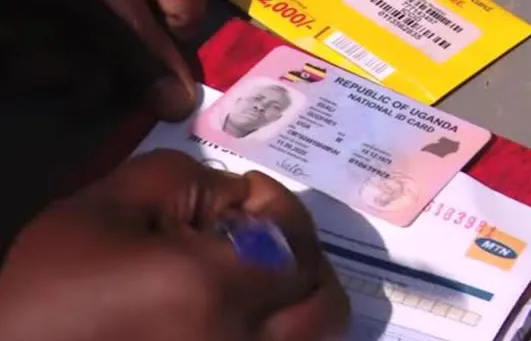

In a bid to combat the rampant fraud and cyber security in most commercial banks, the Bank of Uganda has granted 74 financial institutions access to the National Identification and Registration Authority’s (NIRA) database.

Under this arrangement, banks will have full access to customers personal information and collect pre-agreed customer data, which will be submitted to the e-Know Your Customer (KYC) system hosted by the Bank of Uganda for authentication, which will enable banks to know the true identity of the person they are dealing with, and in case of anything, they will easily know where to find them.

This has left many customers in different banks skeptical of their privacy rights and confidentiality that might be put at risk, as we have been having occurrences of fraudsters impersonating people’s identities to withdraw money in the banks.

Will this system make it worse?

Another thing that came to my mind is, do we now require a national ID to open an account in these banks since they have direct access to the NIRA data base?

Also, on several occasions, dishonest bank staff connive with fraudsters to share private information in the form of passwords and other personal information with a third party.

However, the law is very clear on breaching of personal data and highly penalizes the culprits under the Data Protection and Privacy Act 2019, which is implemented by the Personal Data Protection Office of the Bank of Uganda. Hence, anyone caught involving themselves in such acts will face the long arm of the law.

In today’s era where digital transactions are becoming the order of the day, using Know Your Customer (KYC) measures will mitigate the rising fraud, enhance cybersecurity, and improve financial inclusion as long as customer’s privacy is protected.