The Bank of Uganda has tasked traders with embracing efficient electronic financial services to reduce reliance on physical currency notes and coins, which can be costly to produce, transport, and secure.

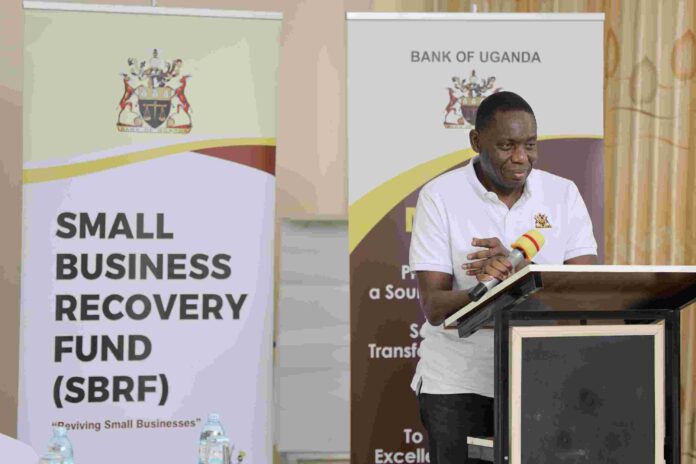

Michael Atingi-Ego, the Deputy Governor of BoU, while engaging with over 200 people from various districts within the Lango sub region during a public consultative gathering in Lira City, said that while they (the BoU) maintain a clean note policy and ensure that money is widely available, hard cash production is expensive and consumes valuable resources.

In his key note address to traders, Atingi-Ego encouraged them to use mobile money and discouraged “cashing out” of the system to reduce these costs.

“This approach benefits the environment and promotes the growth and maturity of the digital financial services industry, which, in turn, fosters financial inclusion with increased participation of the population in the money economy.

The BoU is now also tasked with ensuring the safety and soundness of the country’s payment systems, which facilitate transactions such as mobile money,” said Atingi-Ego.

He noted that whereas mobile money transactions have made financial services more accessible to a wider population, the public must remain conscious of the risks associated with electronic financial services, such as fraud and hacking.

“We are actively working to promote digital financial literacy and protect users from IT and cyber security threats. We encourage all stakeholders to collaborate in minimizing IT threats and cyber security risks to ensure the robustness and efficiency of electronic financial services,” said Atingi-Ego.

In partnership with various partners, including intelligence agencies, the Uganda Communication Commission launched the “Be Better” campaign a few months ago to encourage Ugandans to adopt the use of digital money with the requisite knowledge on how to safeguard their money from fraudsters.